The owner of Sports Direct has become the fourth-largest shareholder in online fashion retailer Asos.

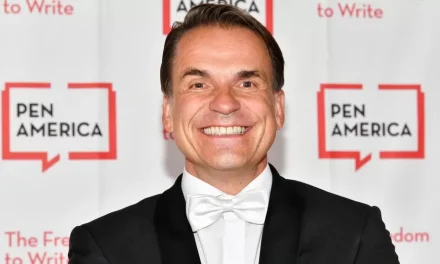

Frasers Group, which is owned by billionaire Mike Ashley, now owns 5.1% of Asos after building up shares in the company that holds the Topshop brand.

On Monday, Frasers also announced it had raised its investment in Hugo Boss.

The company has bought up a number of UK retailers over the past few years spanning sportswear, fashion, furniture and bikes.

It now owns 4.3% of Hugo Boss shares directly and an extra 28.5% through the sale of financial instruments known as put options.

A put option is a contract that allows the owner the right to sell an asset at a future date at a predetermined price. Unlike normal shares, buying put options does not contribute to owning a majority stake or gaining voting rights in a company.

“Frasers Group has extensive ambitions to grow the business inside and outside of the UK and is constantly exploring the potential for further expansion,” the company said.

The retail giant added the move was the latest example of its “its drive to expand and acquire businesses and brands that can strengthen Frasers Group”.

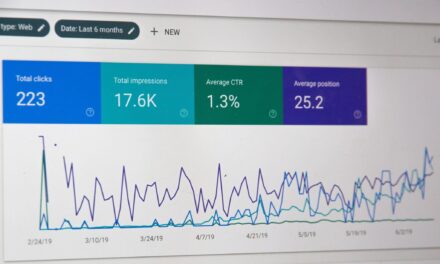

Asos recently reported a loss as the cost of living hit shoppers’ budgets and the company has warned that it expects people to cut back even further in the months ahead.

The online fashion brand’s share price has fallen by nearly 80% over the past year.

Frasers Group said its latest deal was part of the “ordinary course of business to develop relationships and partnerships with other retailers, suppliers and brands”.

Mr Ashley, who founded the sportswear retailer Sports Direct, has in the past gone on to take over businesses he invests in, including House of Fraser.

This year he stepped down as chief executive of the company, handing over the role to his son-in-law, Michael Murray, though Mr Ashley remains the controlling shareholder in the group.

Mike Ashley bought up a host of well known brands over the years and it seems that his son in law Michael Murray also has a similar appetite for deals.

Frasers Group has been on a bit of a spending spree this year. It bought Studio Retail out of administration in February followed by online fast fashion retailer Missguided in the summer, and it’s also having a tilt at buying the Australian online business My Sale.

Now it’s the fourth largest investor in Asos. So what’s the new chief executive up to? The best guess is that Frasers is after a commercial relationship with Asos, seeking more exposure to younger fashion shoppers.

Frasers has already said it wants to expand its business both here and abroad. It clearly has the financial firepower to do so. But taking a stake in Asos could also simply be a financial punt on a business whose share price has crashed in the past year.

line

Danni Hewson, financial analyst at AJ Bell, said Mr Ashley’s latest moves showed “clearly the retail kingpin is not done with the sector just yet”.

“Asos’ financial results revealed some significant problems for the business as spending by its core demographic dries up and the company faces rising costs and a more perilous balance sheet position, but Ashley clearly believes there is still value in the brand,” she added.

The increase in Frasers’ shareholding in Asos – first reported by the Sunday Telegraph – will not give it any control over the online fashion business or a position on its board.

Along with House of Fraser and Sports Direct, the group also owns Flannels, Game, Jack Wills, Evans Cycles and Sofa.com.

The group has also built a significant shareholding in the fashion brand Mulberry.

To read the original article please click here: https://www.bbc.co.uk/news/business-63370575